How I Lost $7 Million

Table of Contents

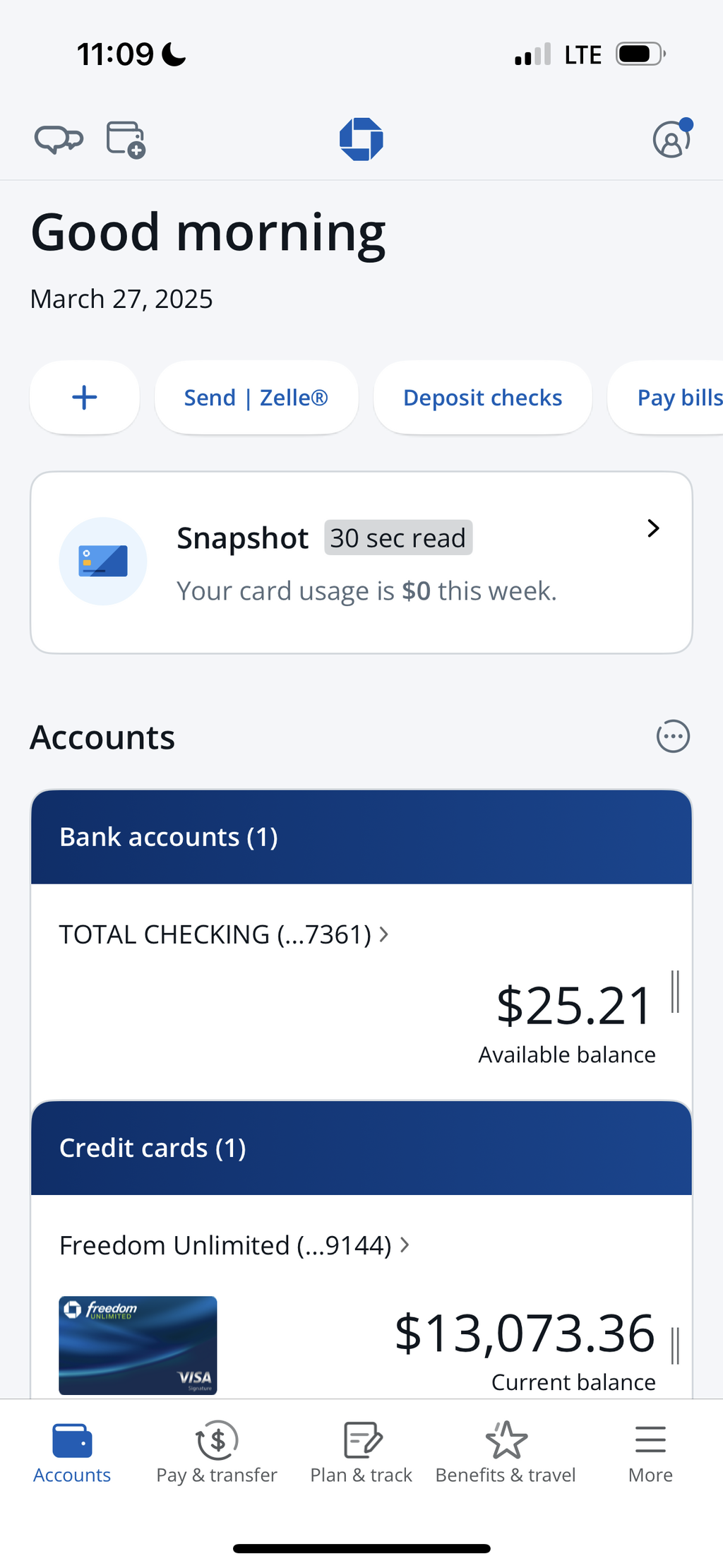

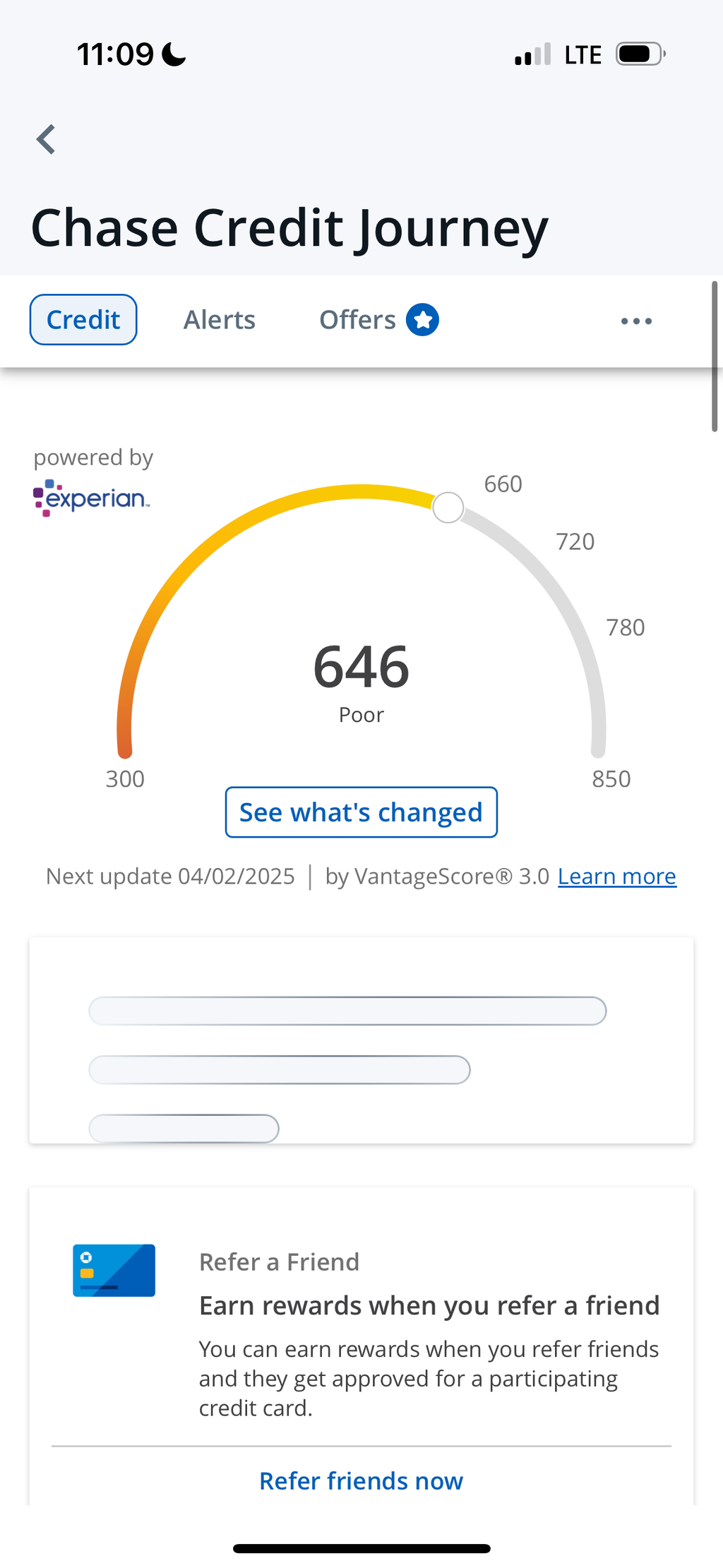

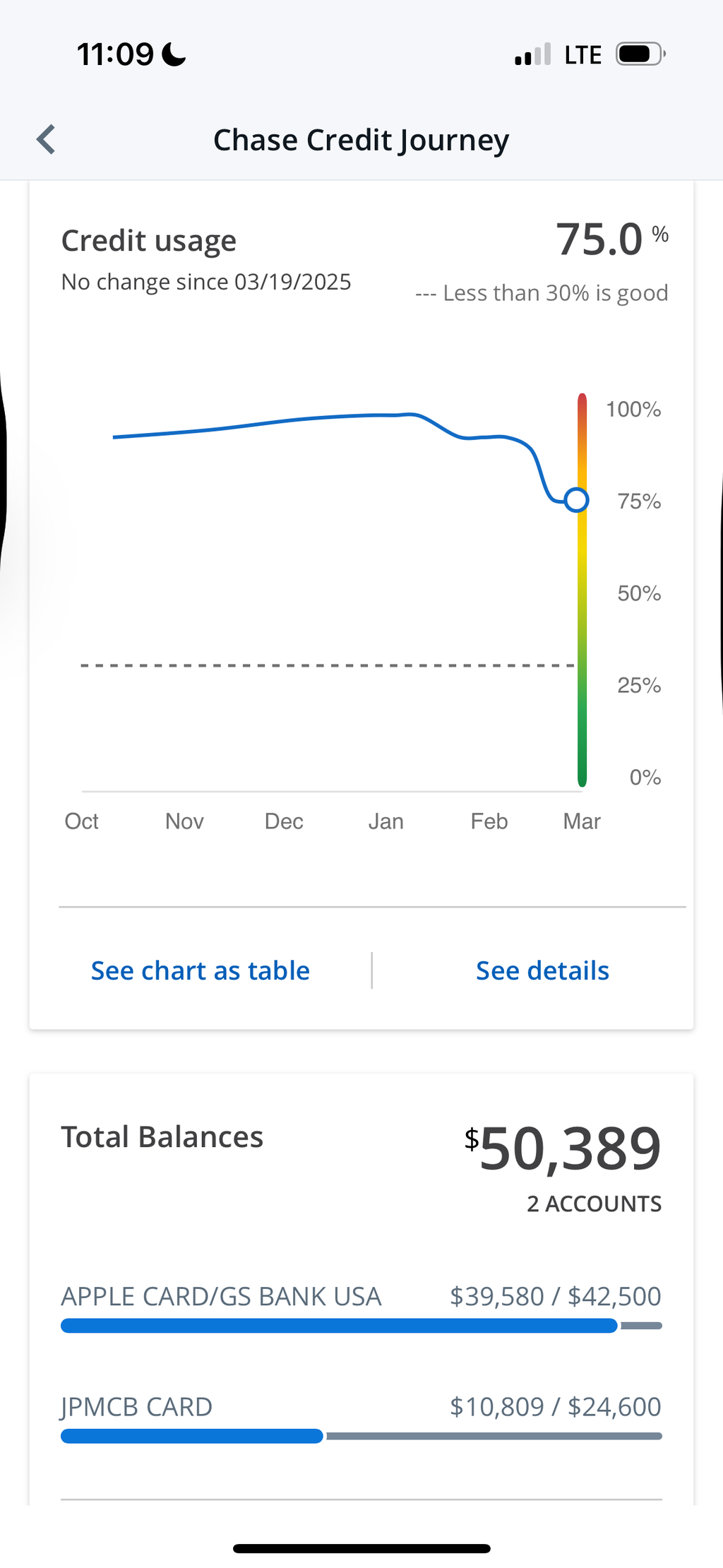

The year is 2025. I’m turning 40 soon, sitting in a cramped 450-square-foot apartment with thin walls, $50,000 in credit card debt, and a credit score of 646. My financial worth: $100 in liquid assets. My net worth: deeply negative.

Five years ago, I was worth over $7 million.

This isn’t a story about market crashes or economic downturns. This is a story about human fallibility—specifically, mine. If you’re looking for a cautionary tale about greed, overconfidence, and the psychological pitfalls of sudden wealth, welcome. I’ve lived it all so you don’t have to.

The Unlikely Millionaire #

My journey to millions began in 2013 at age 27. Fresh off being fired from Newfield Wireless and sharing a house with five roommates, I was a Canadian on a TN visa—meaning I needed employment quickly or I’d be forced back across the border.

My job search led me to a promising startup called Airbnb. After acing their technical interviews (partly because I wrote my solution in C++ while other candidates used slower languages like Ruby and Python), I landed an offer: $120,000 base salary plus 12,500 stock options.

I turned down competing offers with higher salaries, enchanted by Airbnb’s mission and potential. Those 12,500 options would eventually multiply to 72,000 through stock splits. Though I only stayed 22 months, my vesting period earned me 33,000 shares:

$$ {22 \over 48} \times 72,000 = 33,000 $$

Expressed another way:

$$ {22 \over 48} = {33,000 \over 72,000} $$

Fast forward to February 2021: Airbnb’s post-IPO stock price peaked at $216 per share. My stake: $7.1 million. I had won the Silicon Valley lottery, something I will probably never do again.

From Millionaire to Miscalculator #

The cracks had already begun forming years earlier, around 2017, after I left my post-Airbnb position at Mesosphere. Following a string of unsuccessful interviews at tech giants, I pivoted toward what seemed like another golden opportunity: cryptocurrency.

I built trading bots just before the 2018 crypto boom and rode the wave to another brief millionaire status. But when the market crashed, I doubled down instead of diversifying. I sank $250,000 into a Bitcoin mining operation that quickly became worthless. I gave away significant sums, operating from a mindset of abundance that would soon prove illusory.

After an unpleasant stint at Citadel followed by a position at Braze, I made what I now recognize as my fatal financial mistake: leaving stable employment to chase entrepreneurial dreams without adequate preparation or risk management. I launched a series of startups that each failed in uniquely educational but financially devastating ways.

The Unraveling #

By 2020, pre-Airbnb IPO, my financial situation had deteriorated to the point where I could no longer afford my rent. I was surviving on day trading from a Robinhood account when COVID hit, bringing market volatility that demolished what remained of my non-Airbnb portfolio.

When Airbnb finally went public and my six-month lockup period ended, I had my second chance at financial security. Instead, I saw it as an opportunity to recover my previous losses through increasingly complex and leveraged market positions. I was playing a game I didn’t fully understand with stakes I couldn’t afford to lose.

The numbers tell the story with brutal efficiency:

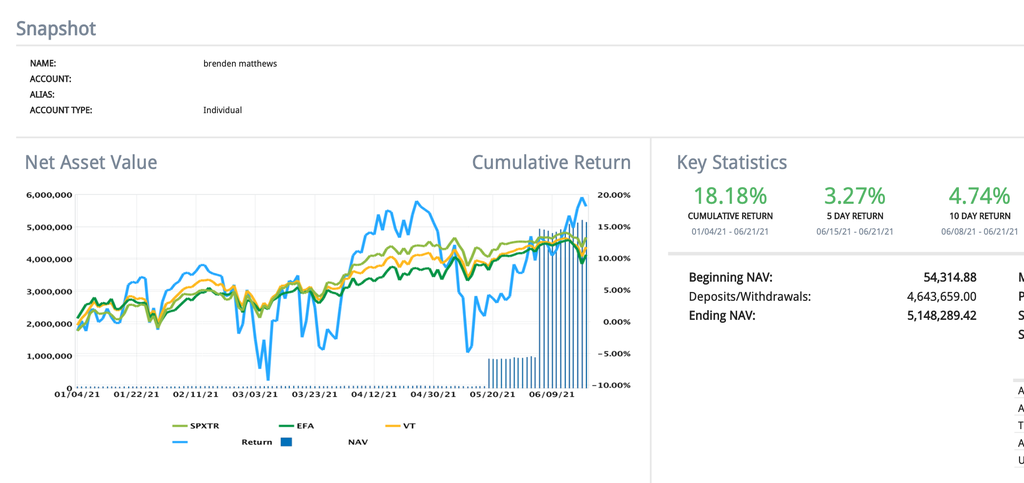

On June 18, 2021, my Interactive Brokers account showed $5.1 million.

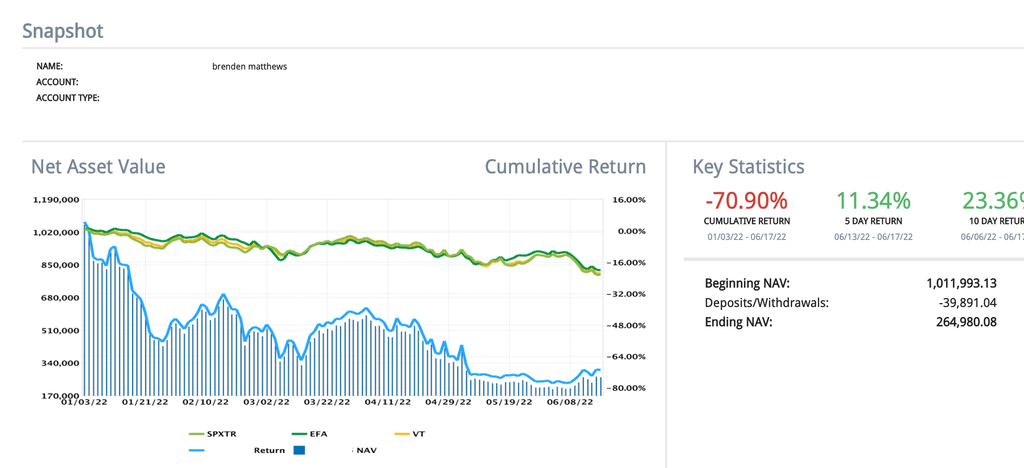

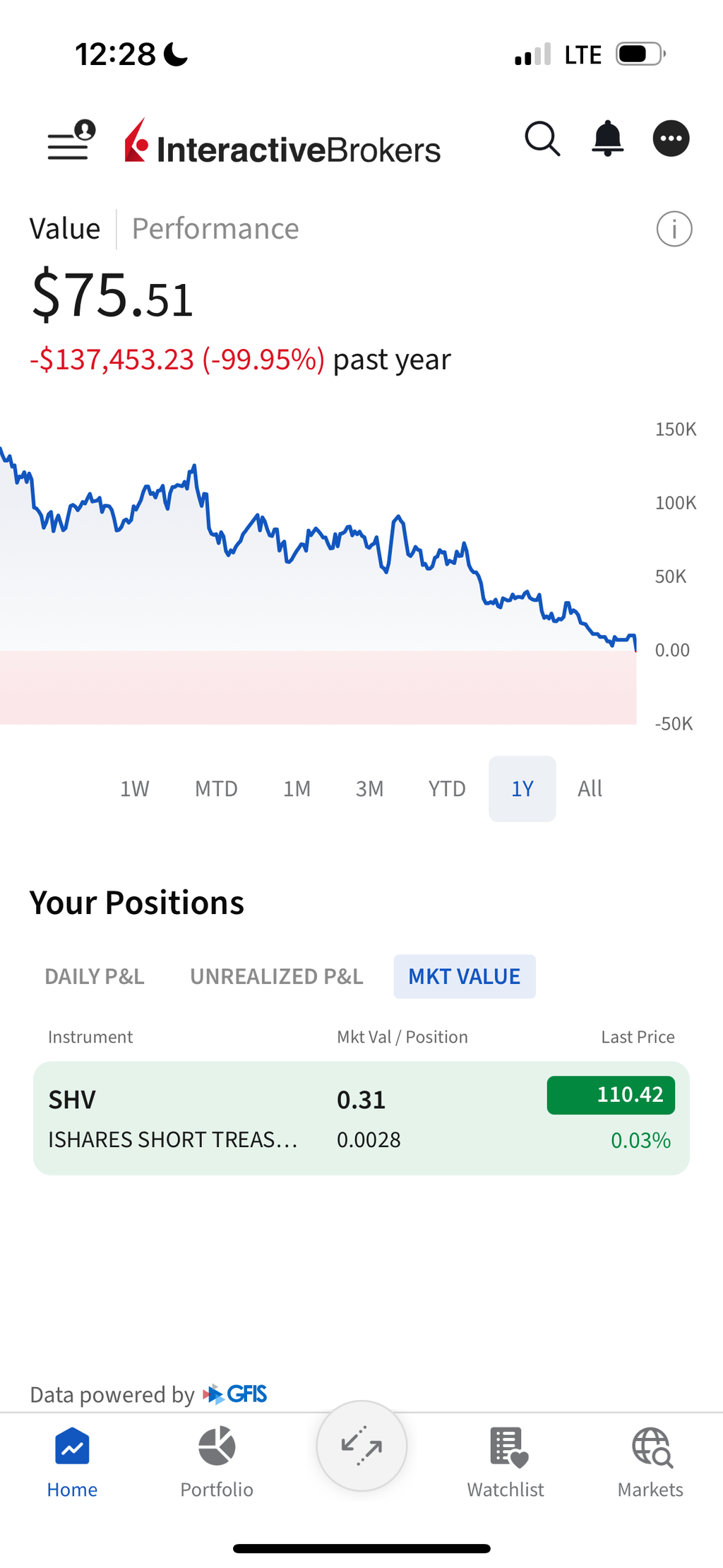

One year later, that same account held just $264,000.

The following years brought a perfect storm of continued financial mistakes, failed startups, and personal challenges. Depression and anxiety became unwelcome companions as I watched my financial security evaporate. My focus narrowed to a desperate search for income as I submitted thousands of job applications, enduring hundreds of interviews over a year and a half before finally securing stable employment.

The Aftermath #

Today, my financial reality is stark:

I have a job I’m grateful for, but my financial horizon has permanently shifted. Retirement savings hover near zero. Home ownership in one of America’s most expensive cities feels like a fantasy. The once-viable path to early retirement has vanished.

The jarring transition from financial abundance to scarcity has taught me how quickly fortunes can change—and how fair-weather many relationships prove to be. One day you’re celebrated for your success; the next, your struggles become inconvenient background noise to former admirers.

The Unexpected Silver Lining #

Here’s the paradox that still puzzles me: I’m happier now than I was with millions. My life has two dogs I adore, meaningful work, and a daily routine that brings genuine satisfaction despite its modesty. The weight of constantly managing wealth—and the fear of losing it—has lifted. Money amplified certain aspects of my personality that weren’t my best, and its absence has forced me to reconnect with what truly matters.

If I Could Do It All Again #

When people ask what I’d do differently, I struggle to answer honestly. Each decision made sense at the time with the information and emotional state I had. I don’t regret my generosity, though it contributed to my downfall. I don’t regret taking entrepreneurial risks, though they didn’t pay off.

What I would change is my approach to risk management. I’d create financial firewalls to protect a core of wealth from my own worst impulses. I’d recognize that helping others requires first securing your own position. I’d accept that market timing is a game where even professionals mostly fail.

And I’d remind myself that money is a terrible measuring stick for success or worth.

Moving Forward #

Writing this has been cathartic. I’m not seeking sympathy or advice—just sharing a cautionary tale that might help someone else avoid similar mistakes. The weight of secret failure is heavier than public acknowledgment of one’s missteps.

It should be noted that I left many details out of this story, but I have to save some content in case I ever write a book. And those additional details don’t change the essence of the story.

My silver lining is a substantial tax loss carryforward that will shelter future gains, should I ever have any. More valuable is the perspective I’ve gained on what constitutes a good life. It isn’t the balance in your accounts but the relationships you nurture, the meaningful work you do, and your capacity for contentment regardless of circumstance.

You can always make more money. You cannot make more time. Use yours wisely.